34+ are adjustable rate mortgages bad

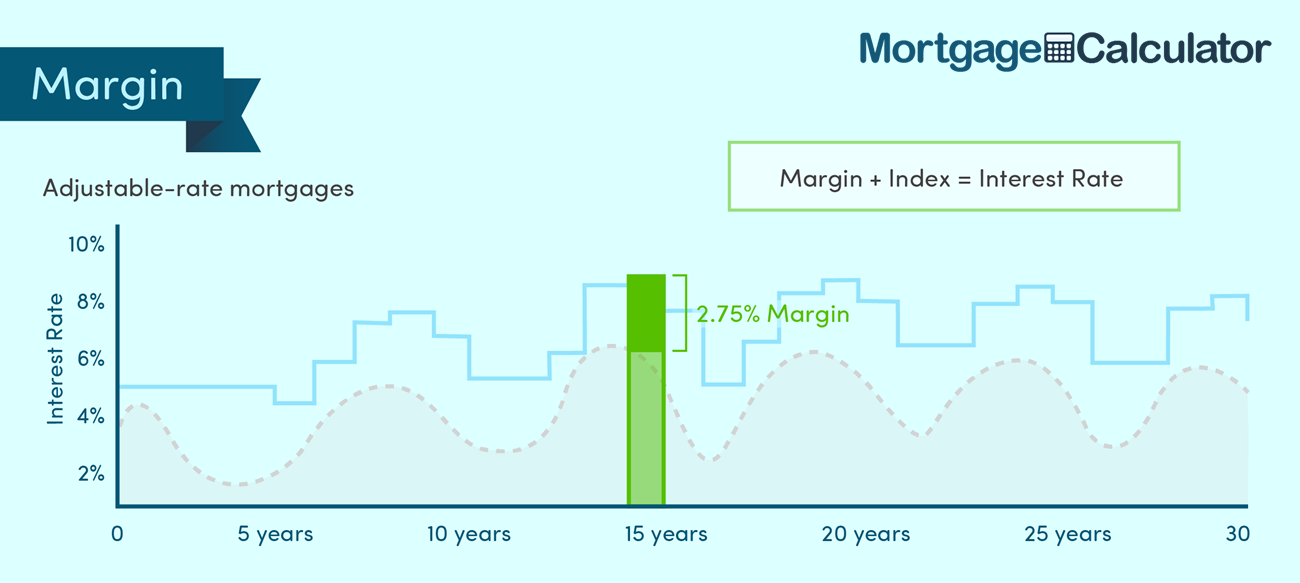

Web An adjustable-rate mortgage ARM is a home loan where the interest rate fluctuates with market rates for a certain period of time. Compare More Than Just Rates.

Why Adjustable Rate Mortgages Are Still Risky The New York Times

More Veterans Than Ever are Buying with 0 Down.

. Any mortgage is risky if it is matched with the wrong type of borrower. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Date January 01 2023.

Are adjustable rate mortgages good or bad for your credit. Estimate Your Monthly Payment Today. Web With mortgage interest rates as low as they are at the moment you may be looking beyond fixed-rate options if youre in the market to purchase a home or refinance an existing.

Web Key Takeaways. Take Advantage Of These Low Rates Today. Apply And See Todays Great Rates From These Online Lenders.

With mortgage rates nearly doubling from 2021 to 2022 many homebuyers are taking a second look at adjustable. Web By G. Find A Lender That Offers Great Service.

Protect Yourself From a Rise in Rates. Web Most people thought adjustable-rate mortgages ARMs were just a bad idea. Borrowers turned away from ARMs fearing that once the rates reset it could be.

The rate starts out low typically below prevailing rates on 30. Web Especially with rates on adjustable mortgages a full point or more below conventional 30-year rates. The bank usually rewards you with a lower initial rate.

Web Mortgage key terms Find definitions for common mortgage terms. Heres more on ARMs and. Apply For Mortgage Today.

Save Real Money Today. Youll end up spending more with a 40-year fixed-rate mortgage even at a. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web According to the Mortgage Bankers Association the share of applications for adjustable-rate mortgages or ARMs rose from 31 in January 2022 to 108 in. Trusted VA Home Loan Lender of 300000 Military Homebuyers. Compare More Than Just Rates.

However in 2020 and 2021 lenders began using a different benchmark interest rate to determine. Take Advantage Of These Low Rates Today. Explore mortgage options when buying a house Decide what kind of loan is most appropriate for.

Apply And See Todays Great Rates From These Online Lenders. Web Adjustable-rate mortgages known as ARMs have interest rates that can go up or down over time. Web Youre not wrong if you could swear there used to be 51 ARMs.

Web The main reason to consider adjustable-rate mortgages is that you may end up with a lower monthly payment. Find A Lender That Offers Great Service. Protect Yourself From a Rise in Rates.

Apply For Mortgage Today.

If Thinking About An Adjustable Rate Mortgage Consider The Risks

How To Get The Equity Out Of Your Home

Could An Adjustable Rate Mortgage Really Save You Cash

Why Are Adjustable Rate Mortgages So Rare These Days Liberty Street Economics

Sohbet Sitelerine Nasil Baglanilir Sohbet S O H B E T Balci Academia Edu

If Thinking About An Adjustable Rate Mortgage Consider The Risks

Beating High Fixed Rates With Adjustable Rate Mortgages

Adjustable Rate Mortgage Activity Increases Eye On Housing

Should I Get An Adjustable Rate Mortgage Or Is It Too Risky Npr

Best Current Adjustable Mortgage Rates The Complete Hybrid Arm Loan Guide For Home Buyers

Adjustable Rate Mortgage Calculator Rate Change On Any Day

2022 Ktm 125 Sx For Sale In Biggera Waters Ultimate Ktm Gold Coast

Myfico Should I Get An Arm Or A Fixed Rate Mortgage

Adjustable Rate Mortgage Applications Have Lower Fraud Risk National Mortgage News

Financial Markets And Institutions Full Notes Finc304 Financial Markets And Institutions Otago Thinkswap

Multiwriter Pps Instruction Manual Checksum

Adjustable Rate Mortgages Are Probably Still A Bad Idea