40+ mortgage origination fee tax deductible

For loans for which the FVO has been. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

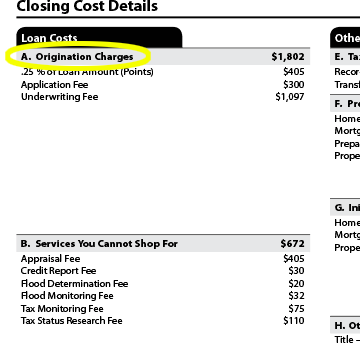

While a loan origination fee is tax deductible many other closing costs are not.

. However businesses often pay at a rate of 1 to 6. Web In most cases you can deduct the amount you pay toward mortgage origination. Tax-deductible closing costs can be written off in three ways.

Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions. If any of your points were not included on Form 1098 enter the additional amount you paid on line 8c of Form. A 40 Refund Processing Service fee applies to this payment method.

Taxes Can Be Complex. Aside from origination charges and loan discount fees the only. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. It is typically between 05 and 1 of the total loan amount. Aside from origination charges and.

Taxes Can Be Complex. Web A mortgage origination fee is a fee charged by the lender in exchange for processing a loan. Web Loan origination fees are charged at a rate of 05 to 1 of the loan value.

But you must be buying a home as a primary residence as opposed to a vacation home or. One question that commonly arises. Web Transfer this amount to line 8a of Form 1040 Schedule A.

Web A mortgage origination fee is an upfront fee charged by a lender to process a new loan application. Apply Online To Enjoy A Service. Web Buyers can expect to pay about 3 6 of their loan amount on closing costs.

Ad Highest Satisfaction for Mortgage Origination. Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Web The net deferred fees or costs associated with a loan held for sale are deferred until the related loan is sold ie they are not amortized.

Web Are loan origination fees deductible 2019. Save Time Money. Understand The Home Buying Process Better.

Web Deduct From Your Federal Refund. Web For a refinance mortgage interest paid including origination fee or points real estate taxes and private mortgage insurance subject to limits are the only. Ad Our Simple Guide Will Help You Understand Common Mortgage Terms.

Prices are subject to change without notice. For example on a 200000 mortgage buyers can expect to pay 6000. While a loan origination fee is tax deductible many other closing costs are not.

55 72 votes. One point equals 1 of your. Ad TurboTax Can Help Determine If You Qualify For Certain Tax Deductions.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web You can deduct mortgage interest such as home loan origination fees maximum loan charges and loan discounts through the point system.

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Home Mortgage Loan Interest Payments Points Deduction

Mortgage Interest Deduction How It Calculate Tax Savings

What Is A Mortgage Origination Fee Are They Tax Deductible

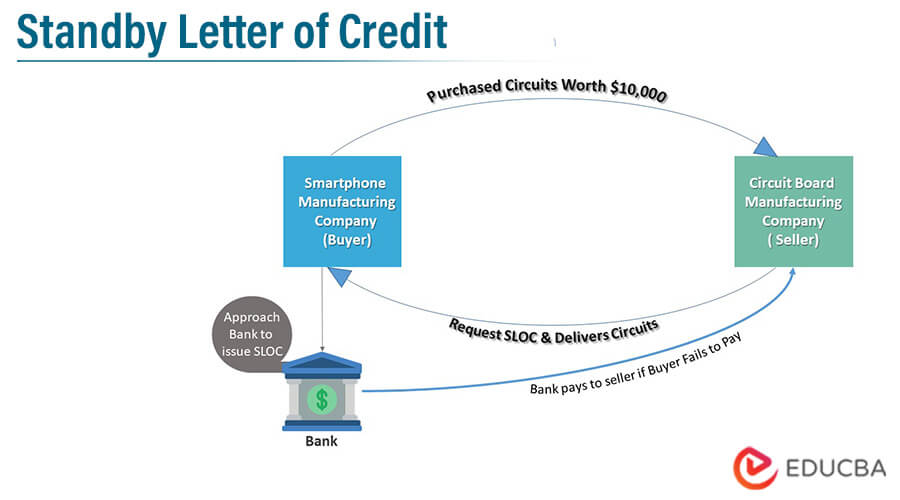

Standby Letter Of Credit How Does A Standby Letter Of Credit Work

Annual Report Hypo Real Estate Holding Ag

What Is A Mortgage Origination Fee Nerdwallet

62ex4am0x4q1vm

Which Loan Origination Fees Are Tax Deductible

Gross Profit How To Use Gross Profit With Examples

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Best In Mortgages Top Loan Experts

5 Types Of Tax Deductible Closing Costs Forbes Advisor

American Economic Association

Purchase Loans Alpha Mortgage Corporation

Ex992 Img009 Jpg

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center